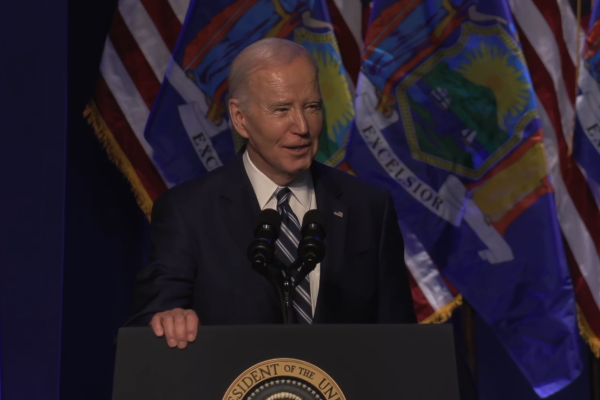

SYRACUSE, N.Y. – For some who chose to pursue higher education, the debt accrued from student loans outweighs the value of their schooling. President Biden is determined to lift some of that pressure.

Despite the Supreme Court’s ruling on June 30, Biden and the secretary of education, Miguel Cardona, managed to implement a new program on July 14.

According to the Department of Education, the new plan will relieve $39 billion to over 800,000 borrowers. The DOE’s new payment plan, Saving on a Valuable Education (SAVE), which will cut down on monthly payments.

A borrower making less than $15 an hour will not need to make any payments. Borrowers who make above $15 an hour will save over $1,000 per year on the new plan.

The program comes two weeks after the Supreme Court ruled 6-3 against Biden’s previous student loan forgiveness plan. According to court documents, the president and secretary of education did not have the authority to forgive loan debt through the Higher Education Relief Opportunities for Students Act (HEROES) of 2003.

According to the Associated Press, President Biden’s previous plan was to forgive $10,000 to those who make less than $125,000 annually or $250,000 per household. Students who received Pell Grants, which are meant for low-income families, would have been relieved of $20,000.

Many were quick to point out the project’s total cost. The Congressional Budget Office has estimated the total cost to be over $400 billion.

Critics of the plan question why relief would be given to those making six figure salaries. They’ll also point to “fairness,” argue that the burden will be placed on taxpayers or say that the plan is merely a bandage over a much larger issue.

According to U.S. News & World Report, college tuition and fees have more than doubled in the last 20 years. In-state costs specifically have nearly tripled.

More information on the new relief program and SAVE plan can be found on the DOE’s website.