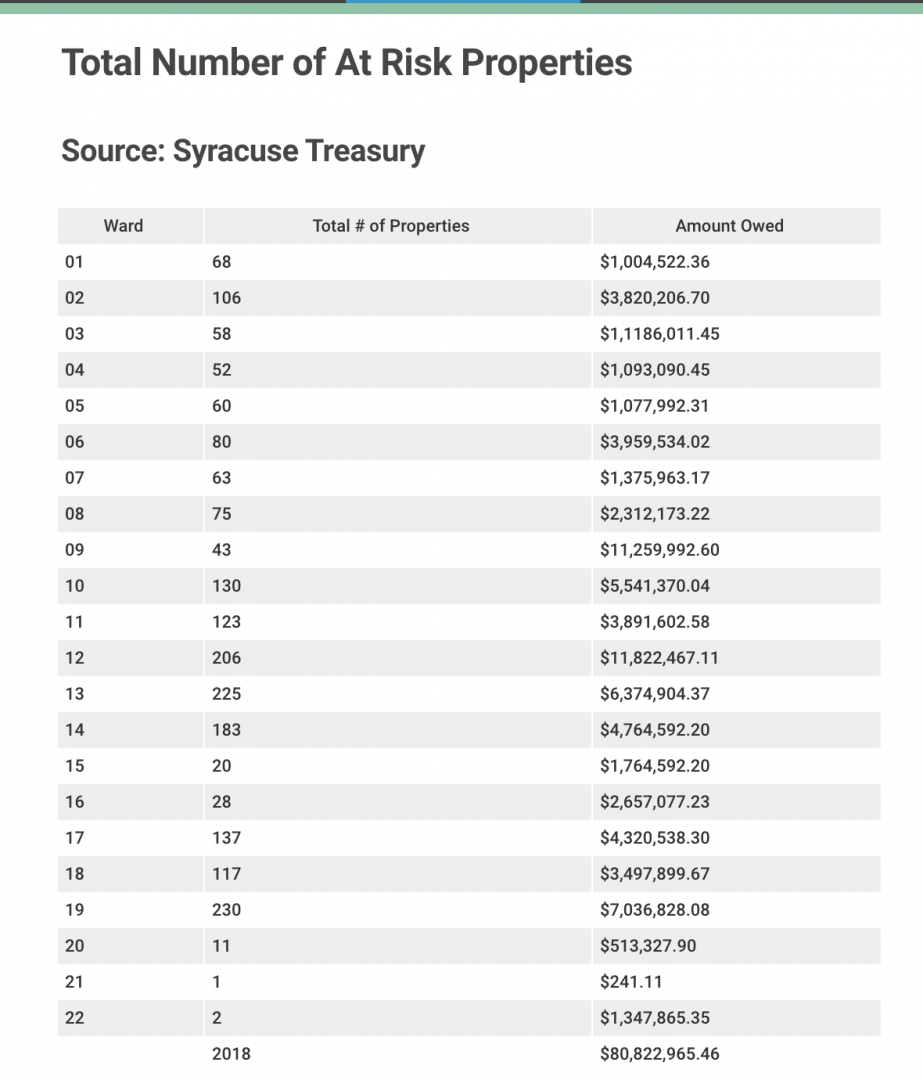

By Rebekah Castor (Syracuse, N.Y.) — According to the Syracuse Treasury, nearly 2,000 properties in Syracuse are at risk of being seized by the city. Property owners have until April 6th to pay off their property taxes before the city steps in.

“The properties that we seize will often be transferred to Syracuse Greater Land Bank,” Stephanie Pasquale, Commissioner of Neighborhood and Business Development, says “We don’t just hang onto the properties. There’s a process for dealing with each specific piece of land.”

Pasquale says that while many of the properties on the list are actually vacant lots, a number of them are owned by “out-of-town landlords.”

“The theory and I think what we experience [with out of town landlords] is you’re not here so it’s like out of sight, out of mind,” Pasquale says. “You’re not paying attention to your property. It’s not an asset to the community. Often, it’s not increasing value but detracting from the value of the neighborhood.”

A new enforcement tool is launching to keep landlords more accountable. Under a new law, the city can now ticket landlords who do not keep up with their code violations. Pasquale hopes this will keep out-of-town landlords up to date on their property tax payments.

Besides vacant lots and out-of-town landlords, property owners on the Southside also raise a problem. The city’s Southside is part of Syracuse’s 12th ward. This ward is responsible for $11,822,467.11 in property taxes, according to the Syracuse Treasury. One resident of the Southside, Andrew Barlow, says a lack of education is one reason why his neighbors can’t pay their taxes.

“The best jobs around here require a high school diploma,” Barlow says. “A lot of people around here have a hard time finding well-paying jobs because when they were in high school they had to work instead of getting an education.”

Property owners can pay their bill in person or mail it to the Syracuse Treasury Office, Room 122 in City Hall, 233 E. Washington St. Liens. Bills can’t be paid online.

Source: Syracuse Treasury