By Liv Johnson CORTLAND, N.Y. (NCC News)

Trump, tariffs, trade war, and China – these words have filled news headlines for over a year now. When Trump put the tariffs on Chinese imports and exports into effect last July, the future of American businesses that relied on trade with Chinese partners were thrown up in the air.

Companies like Gutchess Lumber – a fifth-generation family-owned business that’s produced premium hardwoods in New York since 1904 – sell a vast majority (54%, to be exact) of their products to China, and therefore have been directly impacted by the strained trade relations.

“The truth is, the demand for hardwoods in America has been decreasing for decades…When people criticize the amount we sell to China, I want to ask them – well how much lumber are you willing to buy, and for what price?” said Matt Gutchess, President of Gutchess Lumber Co.

Sales by lumber companies across the nation show the same trend. Add the decrease in demand in America to the increase in demand in China, and the result is that the U.S. hardwood industry exports about $2.2 billion a year in lumber to China. In fact, the U.S. sent more than half of all of its exported hardwood lumber by volume to China in the first seven months of 2018. In the first seven months of this year, however, the share of exports dropped to 41%.

“It’s a luxury product in China…It’s basically a status symbol. In China, if you have American hardwood, it’s a sign that you’ve earned something,” Gutchess said.

Gutchess said his exports to China grew from almost nothing in the 1990s to about half of the company’s business in 2017. This trade growth, said Gutchess, became especially important during the 2008-2009 recession. “Without China, 80% of lumber companies wouldn’t be here right now. The business we had with them overseas really helped us out during those times” he said.

Since July of 2018, though, (the month Trump implemented the tariffs) Gutchess Lumber’s revenue is down 20-25%.

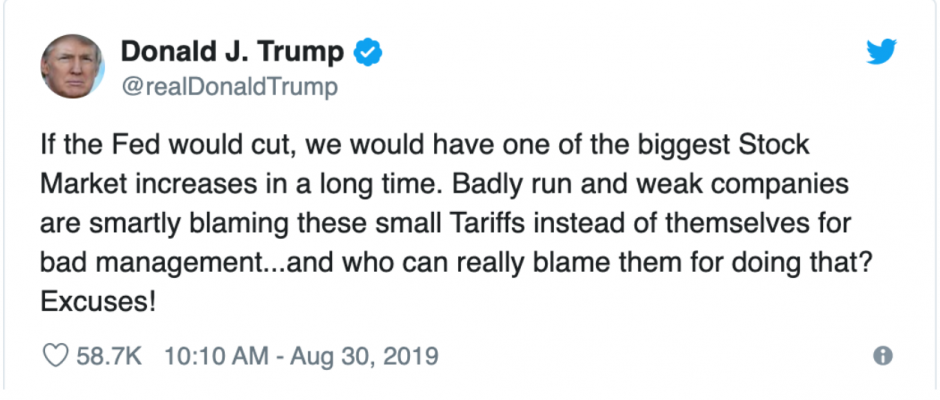

President Trump and supporters of his tariffs have criticized companies like Gutchess for relying too much on business with foreign countries.

According to business owners like Gutchess, though, the tariffs on imports and exports are hurting Americans more than they’re hurting Chinese. With the loss of revenue comes the loss of production, the loss of payroll for employees, the loss of pay for the company’s machinery, equipment, etc.

“I think what people miss is that we’re taking a huge quantity of money and we’re bringing it back here and it’s going right back into our communities. If we’re paying a worker $50,000 a year, 25,000 of those dollars are Chinese dollars. So whether you like the country or not, we’re taking the dollars back here and we’re reinvesting them in our people, our equipment, and our business,” Gutchess said.

Lastly – and what Mr. Gutchess seemed most concerned about – are the effects that slowed American lumber production will have on the environment.

As China looks to buy lumber from other countries with more lenient trade policies, such as Siberia and/or Africa, countries that do not prioritize environmentally-conscious practices – or stay weary to important forest and rainforest deforestation – will amp up their lumber productions, thus depleting vital resources and sacred lands.

“By managing the forests actively, you are constantly encouraging much faster growth. In fact, they’re growing so fast that they’re sucking carbon out of the atmosphere. A young forest pulls more carbon out of the air than a tropical rainforest,” Gutchess said.

These positive effects that industrial lumber practices can have on forestry, though, is only possible if countries are adamant about sticking to safe, resourceful, and efficient methods. The countries that China has been turning to are not known for their standards of lumber practices.